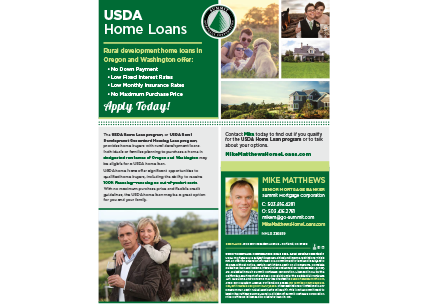

Mike Matthews

SENIOR MORTGAGE BANKER

Mike Matthews Home Loans NMLS 326869

C: 503.816.4281 | O: 503.416.2781

mikem@go-summit.com

Summit Mortgage Corporation | NMLS 3236

Meet Mike Matthews

Mike Matthews is a true Oregonian. He graduated from Sunset High School in 1984 and then Oregon State University in 1989. Mike played college football and was voted team captain his senior year. After graduation, he worked for Nike and Nautilus Plus. In 1996, Mike accepted his first loan originator position and has been originating loans ever since. His experience and knowledge in the industry allow clients to relax and trust the mortgage process. Mike has two teenage boys: Mitch and Mack. In his down time, Mike enjoys fishing, coaching sports, and hanging out with family and friends.

Purchasing A Home

Your dream home is at your fingertips. Whether you’re buying a home for the first time or looking for the perfect vacation home, we’ll help find the financing option that’s right for you.

Need To Refinance?

Saving money is good. Refinancing can help you obtain a lower interest rate, leverage your home’s equity, or simply lower your monthly payments. Let’s find a refinance solution and make it happen! Capitalize on these low rates.

Niche Products

We offer a wide array of niche products, as well as mortgage loans for manufactured and modular homes, properties with large acreage, Washington State bond programs, low-interest second mortgages, future income programs, extended lock options, and more.

Loan Options

Purchasing or Refinancing in Oregon?

Look no further. I have a wealth of knowledge on a wide range of financing options. Here are just some of the home loan programs I specialize in:

- Conventional Home Loans

- Fixed & Adjustable Rate Mortgages

- Refinancing Home Loans

- Relocation

- Jumbo Home Loans

- Conforming High Balance Home Loans

- Construction & Lot Loans

- Remodel & Rehab Loans

- Residential Investment Loans

- Reverse Mortgages

- Self-Employed Home Loans

- Energy Efficient Mortgages (Green Home Loans)

- EnergySpark Home Loan Program

- FHA Home Loans

- VA Home Loans

- USDA Home Loans

- Good Neighbor Next Door Program

- Home Advantage Loan Program

- House Key Opportunity Loan Program

- Niche Products

Learn more about available loan options and apply today!

Team

Kim Pepper

Senior Loan Processor

O: 503.546.1273 | F: 360.567.2947

kimp@go-summit.com

Taeler Egly

Transaction Coordinator

O: 503.223.6166 | F: 503.328.7172

taelere@go-summit.com

Testimonials

Mike and [Kim] Pepper anticipate every question and possible issue and present you with qualified choices to best fit your needs. A pleasure to work with both of them.

There were bumps in the road, but Mike and Kim kept me on the path in a timely manner to get my loan approved. I couldn’t be any happier. Their support and knowledge is second to none.

Mike is knowledgeable and knows how to help his customers.